Free Consultation: (323) 939-3400Tap to Call This Lawyer

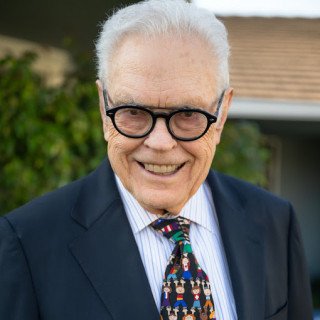

David Ostrove

David Ostrove Attorney At Law

Badges

Claimed Lawyer ProfileQ&A

Biography

I am a dedicated and skilled estate planning and tax law attorney with more than 40 years of experience. My firm delivers expert advice to clients in the Southern California area.

My areas of practice include estate planning, wills, probate, trusts, estates, guardianships, conservatorships, and tax law.

Whatever your estate planning or tax issue is, I will work tirelessly and help you through every step of your case.

Practice Areas

- Legal Malpractice

- Arbitration & Mediation

- Business - Arbitration/Mediation, Consumer - Arbitration/Mediation, Family - Arbitration/Mediation

- Business Law

- Business Contracts, Business Dissolution, Business Finance, Business Formation, Business Litigation, Franchising, Mergers & Acquisitions, Partnership & Shareholder Disputes

- Divorce

- Collaborative Law, Contested Divorce, Military Divorce, Property Division, Same Sex Divorce, Spousal Support & Alimony, Uncontested Divorce

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Tax Law

- Business Taxes, Criminal Tax Litigation, Estate Tax Planning, Income Taxes, International Taxes, Payroll Taxes, Property Taxes, Sales Taxes, Tax Appeals, Tax Audits, Tax Planning

- Family Law

- Adoption, Child Custody, Child Support, Father's Rights, Guardianship & Conservatorship, Paternity, Prenups & Marital Agreements, Restraining Orders, Same Sex Family Law

Additional Practice Areas

- Expert Witness

- Guardianships

- Conservatorships

- Estate Litigation

- Will Contests

Fees

- Free Consultation

Jurisdictions Admitted to Practice

- California

-

Languages

- English: Spoken, Written

- Spanish: Spoken

Professional Experience

- Senior Adjunct Professor of Law

- Southwestern University School of Law

- - Current

- Attorney At Law

- David Ostrove Attorney At Law

- - Current

- Certified Public Accountant (inactive)

Education

- Southwestern University School of Law

- J.D. (1958)

-

- Los Angeles City College

- A.A. (1950)

-

Awards

- AV Preeminent Peer Review Rated

- Martindale Hubbell

- Client Reviewed (5.0/5.0)

- Martindale Hubbell

- Alumnus Of The Year

- Southwestern Law School

Professional Associations

- American Association of Attorneys-Certified Public Accountants

- Member

- - Current

- Activities: President 1991-1992

-

- American Bar Association

- Senior Member

- - Current

-

- California State Bar # 30229

- Member

- - Current

-

- American Institute Of CPAs

- Senior Member

- - Current

-

- California Society Of CPAs

- Senior Member, Author, Presenter

- - Current

-

Publications

Articles & Publications

- "The CPA AS AN EXPERT WITNESS" , "SURVEY OF WILLS AND TRUSTS"

- California Continuing Education of the Bar

Speaking Engagements

- Attorney & Accountant Malpractice, Business Valuations, Tax Accounting Issues & Damages

- Litigation Consultant and Expert Witness

- Wills & Trusts in California: What the CPA Must Know

- California CPA Society; Continuing Education of the Bar

- Preparing Accountings & Reports for Trusts & Estates

- California CPA Society; Continuing Education of the Bar

- Accounting & Auditing for Trusts & Estate

- California CPA Society; Continuing Education of the Bar

- Summary Accounting for Trusts & Estates

- California CPA Society; Continuing Education of the Bar

- 2001, 2002

Certifications

- Certified Specialist, Taxation

- California State Bar

- Certified Public Accountant

- State of California

Websites & Blogs

- Website

- David Ostrove Attorney at Law

Legal Answers

65 Questions Answered

- Q. My question is regarding court papers from the probate conservatorship department saying I am a beneficiary.

- A: Ask the cousin who was appointed executor for copy of will or other testamentary documents. If you are a named beneficiary, you are entitled to see EVERYTHING!

DAVID OSTROVE, ESQ

- Q. I.ve been erroneously garnished by the tax dept I am looking for the best course of action after....

- A: Keep om writing to the authorities not less often then every three weeks. Explain everything, in detail. Do not give up. Eventually you will indeed get their attention and they will respond in a correct positive manner. Don't give up!

DAVID OSTROVE

Attorney at Law

6157 Wooster Ave

L.A., CA 90056

- Q. Can a beneficiary of property in a will legally sell their part of the property 4 years before trustor dies.

- A: Yes, you can sell. BUT

You own a mere expectancy, with probably no value.

You may sell,

But, nobody is going to buy.

Because if you are named in the will or trust and the maker of the will or trust is still alive, he can change the will or trust anytime he wants to.

You do not have a vested interest to sell.

Only a mere expectancy.

Social Media

Contact & Map