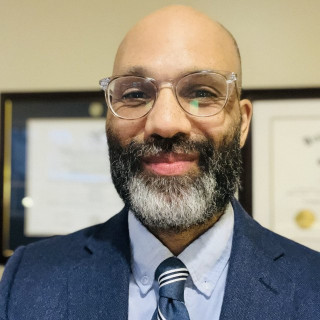

Sat Nam S. Khalsa

Khalsa Law LLC

Sat Nam Khalsa's mission is centered on service, he is dedicated to helping clients resolve difficult problems with excellence and integrity. His clients include individuals, families, small businesses, and nonprofits. Sat Nam Khalsa practices Tax and Business Law, Estate Planning and Probate, and non-adversarial Family Law.

In his tax practice, Sat Nam represents individuals and organizations seeking to resolve tax controversies with the IRS and state and local tax authorities. He also represents clients litigating tax disputes in Federal and State courts.

Sat Nam’s work for business clients, nonprofits and tax-exempt organizations includes advice related to entity formation and Federal tax status, contracts, worker classification, corporate policies and governance, entity restructurings, and ongoing compliance with Federal entities.

Sat Nam also offers clients estate planning and probate law, enabling his clients’ goals to manifest as intended. He has the skill and knowledge to help design an estate plan that serves the client’s needs, as well as navigate through the probate process.

As a lawyer committed to helping clients resolve conflict in the best way possible, Sat Nam also offers services in non-adversarial family law: divorce mediation and collaborative divorce. Both processes give couples a framework to resolve issues according to their own values and needs and are effective alternatives for couples seeking to divorce in a non-adversarial setting.

Sat Nam's service experience began in law school, where he served as Executive Articles Editor of the Georgetown Journal of Modern Critical Race Perspectives. He is an active member of the DC and Virginia Bars and of the Taxation Section of the American Bar Association. Sat Nam also maintains an active pro bono practice and volunteers regularly at the DC Superior Court’s Family Court Self-Help Center, and the DC Bar Pro Bono Program’s Probate Resource Center.

- Tax Law

- Business Taxes, Criminal Tax Litigation, Estate Tax Planning, Income Taxes, International Taxes, Payroll Taxes, Property Taxes, Sales Taxes, Tax Appeals, Tax Audits, Tax Planning

- Business Law

- Business Contracts, Business Dissolution, Business Finance, Business Formation, Business Litigation, Franchising, Mergers & Acquisitions, Partnership & Shareholder Disputes

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Probate

- Probate Administration, Probate Litigation, Will Contests

- Credit Cards Accepted

- District of Columbia

- District of Columbia Bar

-

- Maryland

- Maryland Court of Appeals

-

- Virginia

-

- 5th Circuit

-

- D.C. Circuit

-

- United States Tax Court

-

- English: Spoken, Written

- Principal

- Khalsa Law LLC

- Current

- 2015-Current

- Of Counsel

- Longman & Van Grack LLC

- - Current

- Senior Associate

- Miller & Chevalier

- -

- Operations Manager

- Adico

- -

- Georgetown University Law Center

- J.D. (2010) | Law

- Activities: Executive Articles Editor of the Georgetown Journal of Modern Critical Race Perspectives.

-

- University of British Columbia

- M.A. (1999) | English

-

- University of British Columbia

- B.A. (1996) | English

-

- Excellent Rating

- Avvo

- District of Columbia Bar

- Member

- Current

- Activities: Tax Section, Family Law Section & Estates, Trusts & Probates Section; Law Practice Management Section

-

- Virginia State Bar

- Member

- Current

-

- American Bar Association

- Member

- Current

- Activities: Tax Section

-

- DC Bar Pro Bono Program

- Volunteer, Probate Resource Center

- Current

-

- DC Superior Court, Family Court Self Help Center

- Volunteer

- Current

-

- Exemption from D.C. Income and Franchise, Sales and Use, Personal Property, and Real Property Taxes

- The District of Columbia Practice Manual (Contributing Author)

- New Partnership Audit Rules Require Proactive Response

- Blog Post

- Transfer Pricing for Services under the 2009 Treasury Regulations and OECD Guidelines (Assisting Contributor)

- Practical Guide to U.S. Transfer Pricing, 3rd Edition

- IRS Takes Next Steps in International Realignment

- Miller & Chevalier Alerts IRS Takes Next Steps in International Realignment

- Estates, Trust, and Probate Law, Lunch with a Lawyer

- Worker Classification: The IRS, Department of Labor, and the States, American Bar Association, Taxation Section

- Building a Law Practice, Lunch with a Lawyer

- Planning for Incapacity, Reston Library Seminar

- Certified Kundalini Yoga Teacher

- Kundalini Research Institute